Payroll Reports

Fast Onboarding

Secure Cloud-Based

Employee Self-Service

Our Reach

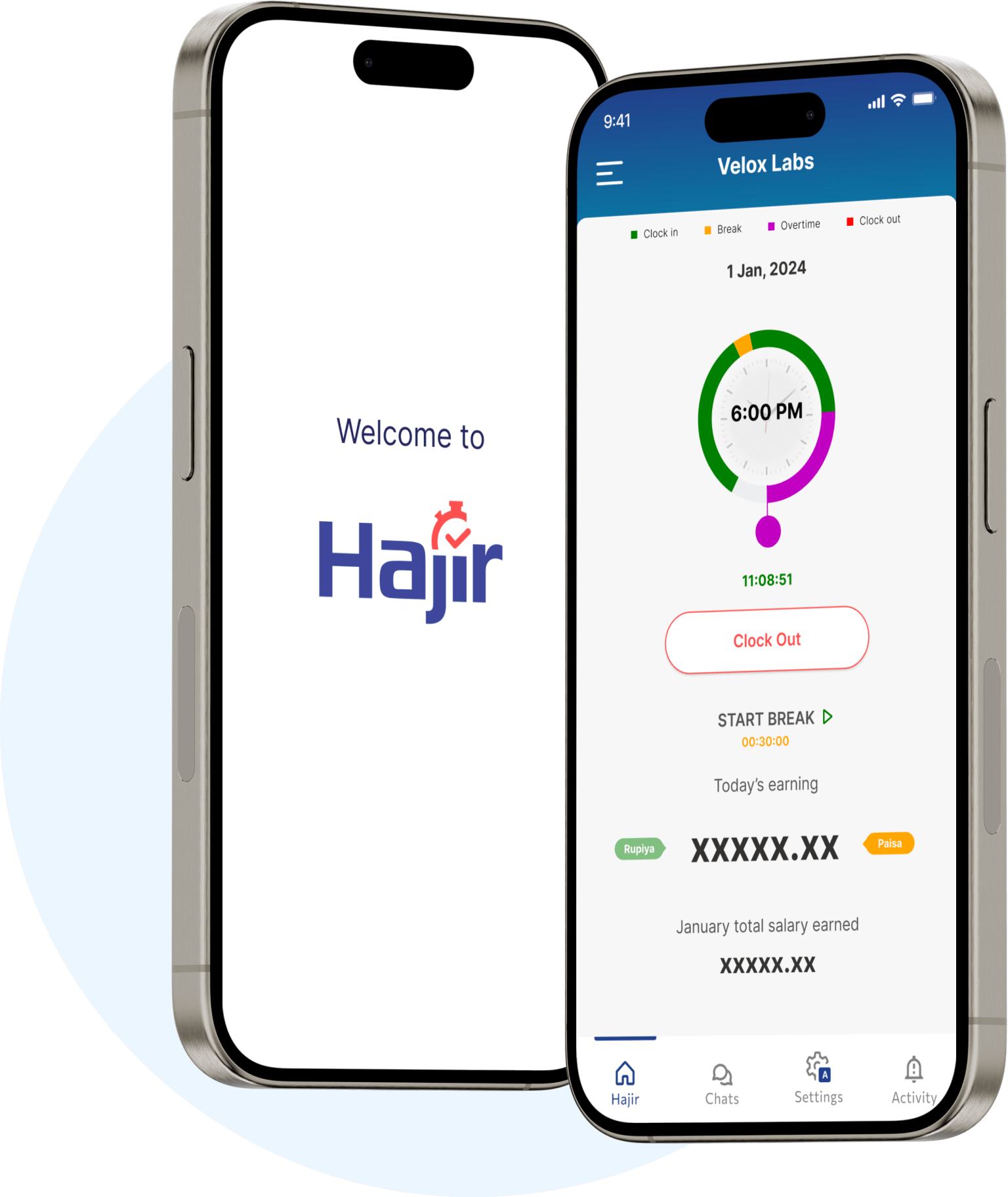

Trusted HR Solution for Every Industry

Across sectors like education, healthcare, technology, and hospitality, Hajir transforms

HR management, making it simple, efficient, and employee-friendly.

Technology

40+

Manufacturer

10+

Financial Services

25+

Hospitality

50+

Healthcare

35+

Education

55+

Retails

25+

Cargo / Shipping

15+

Cooperative

75+

Consultant

35+

Consultancies

100+

Travel Agencies

25+

Construction

25+

Cleaning & Janitorial

17+

Manpower

30+

Food & Beverage

20+

Automotive

20+

Securities/ Broker

5+

Marketing Agency

15+

Real Estate

10+

Media & Entertainment

15+

NGO's / INGO's

10+

Beauty & Cosmetics

5+

Importer & Dealer

15+

Efficient payroll management with detailed reports.

Earnings Overview

Earnings overview summarizes total wages and bonuses received.

Deductions

Deductions include taxes, insurance, and other employee contributions.

Overtime & Leave

Overtime and leave monitor additional hours and absence records accurately.

Transparent Deductions

Transparent deductions offer a clear breakdown of all withholdings from employee salaries, including federal and state taxes, social security, health insurance premiums, and retirement contributions. This clarity helps employees understand their deductions, fostering trust and compliance.

Payroll Adjustments

Payroll adjustments allow for seamless tracking of salary changes, retroactive pay, and error corrections. This feature ensures that all payroll data remains accurate and up-to-date, enabling employers to manage compensation changes efficiently and maintain transparency with employees.

Ready to get started?

Request for demo today!

Real-Time Updates

Real-time updates ensure that payroll data is instantly reflected as changes occur, providing accurate and current information for decision-making. This feature allows managers to monitor employee hours, deductions, and adjustments, facilitating timely payroll processing and reducing errors.

Exportable Data

Exportable data enables users to easily download payroll summaries and reports in various formats, such as PDF, CSV, and Excel. This feature streamlines data sharing and integration with accounting software, facilitating efficient record-keeping and analysis for better financial management.

Secure Data Management

Secure data management protects sensitive employee payroll information through robust encryption and access controls. This feature ensures that only authorized personnel can access payroll data, safeguarding against breaches and maintaining confidentiality, which fosters trust and compliance within the organization.